We've collected the answers to the most common questions we get here. If your question isn't answered, or if you just prefer to talk to a real person right away, you can give us ring, use the Live Chat here on our site, join us on Facebook or send us a message for help.

No – we’ll contact you directly to confirm your prize and payment.

To help us meet AML requirements, we kindly ask you to provide the following documents:

Proof of identity:

A valid government-issued photo ID, such as:

Proof of address:

A valid document that evidences your current residential address, such as:

This must be different to the Proof of Identity provided.

If you’ve got a purchased life annuity, you’ll usually be taxed on it at the normal rate. If your income is below your tax-free Personal Allowance, you’ll be able to claim that tax back. Alternatively, you could ask for your annuity to be paid out without tax taken off.

To claim back the tax you’re owed, you’ll need a form R40 for every year you’ve overpaid. As always, there’s a hard limit of 4-years to get back what you’re owed.

If you want your annuity paid tax-free instead, you’ll send form R89 to your provider, or form R86 for joint annuities. Either way, keep in mind that you’ll have to alert the provider if your income ever goes up. If you start bringing in more than your Personal Allowance, you’ll owe some tax on it.

For pension annuities, you should get a P800 letter from HMRC if you’re owed any tax back. If you don’t get one and think you’re owed money, talk to HMRC.

Most likely, yes. The amounts you receive don’t normally cover everything you’re entitled to.

It is important to know that we deduct HDT or GYH allowances from any claim we make as both are paid non-taxed.

Use our Tax Refund Calculator to find out if you are owed anything from HMRC

If you live in married quarters, on or off base, and spend your leave periods there, it would normally be classed as your main residence. The claim in this case would be for any costs for travel between your married quarters and any temporary postings of up to 24 months.

If you already receive a Home to Duty (HDT) allowance for this already, we will review the amounts received against the allowable limits and claim for any shortfall.

Use our Tax Calculator to see if you are owed a refund from HMRC.

If you live on base part of the time but go home to another address for weekends or longer periods of leave, the leave address would be classed as your main residence.

A tax refund claim in this case would be for travel between your home address and your workplace.

If you already receive a Get You Home Travel (GYH) allowance for this, we will review the amounts received against the allowable limits and claim for any shortfall.

Use our Tax Calculator to find out if you are due a refund.

Yes this is very important as we need to have documentary evidence to support your claim.

Please ensure you keep a copy of each of your Assignment Orders for each base that you have traveled to. You can print these from JPA but please note these are deleted after 60 days.

See our checklist of the documents you will need to make a claim. We can help you get copies of anything you are missing if needed.

It will depend on the type of training.

HMRC has strict rules about what is classed as an allowable expense around training. If it was an essential part of your contractual duties of employment then we might be able to claim for the traveling expense or mileage.

You will need to have completed your phase one training to make a claim.

Even if you not due a refund this year remember that you can claim for the past 4 tax years so use our tax calculator to find out if you are owed anything.

To get a tax refund, HMRC says you need to be travelling to temporary workplaces. Reservists and Territorial Army personnel tend to spend most of their service in one place, which wouldn't qualify and is an example of when you wouldn't be able to claim an MOD tax refund.

That said, your circumstances might be different from most. Get in touch if you want us to look into it for you. It costs you nothing to find out where you stand.

Use our tax calculator to see if you are due a refund

Find out if you need to complete a Self Assessment Tax Return or if you can claim Flat Rate Expenses.

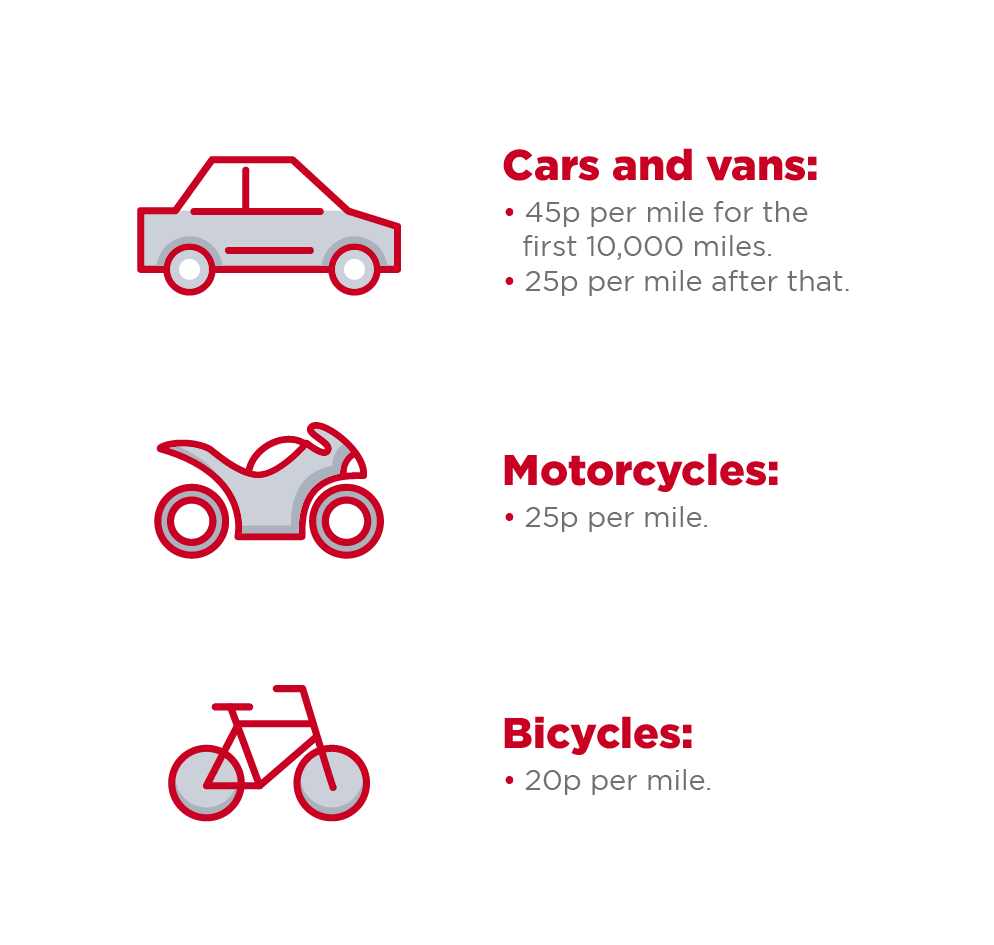

Yes. You are legally entitled to reclaim 24p per mile, which is the difference between the HMRC allowed rate of £0.45 per mile* and the MOD £0.21 per mile tax exempt allowance. To claim this, you must be on temporary duty. This is defined by the relevant HMRC legislation, not by MOD policy.

HMRC mileage refunds explained

Ask RIFT about your specific circumstances if you are still unclear.

*HMRC EIM32080 Travel expenses: travel for necessary attendance: temporary workplace: limited duration, the 24 month rule.

Despite what some people are saying, MOD personnel really can get UK tax refunds. RIFT Refunds always knew this was true and we fought hard to get the proof. You can read the MOD letter to us and feel assured that this is something that can be legitimately claimed for.

Tax refunds for travel can be claimed, as confirmed in DIN ‘2015DIN01-005’ which has been issued to all service personnel to officially confirm this.

There has been a lot of confusion around tax refunds that RIFT has worked hard to clear up with both the MOD and HMRC.

Different interpretations of what is meant by ‘a temporary posting’ have caused this confusion. Some believed that individuals who claimed a tax refund on HDT were doing so in breach of HMRC rules. RIFT can categorically confirm that none of these potential situations can arise and this is confirmed by the MOD.

Some also thought that making any claim for a tax refund may mean the individual may have to repay rebated money in the future. Others also thought claiming a refund would jeopardise the whole tax exemption of the MOD HDT allowance, disadvantaging many service personnel.

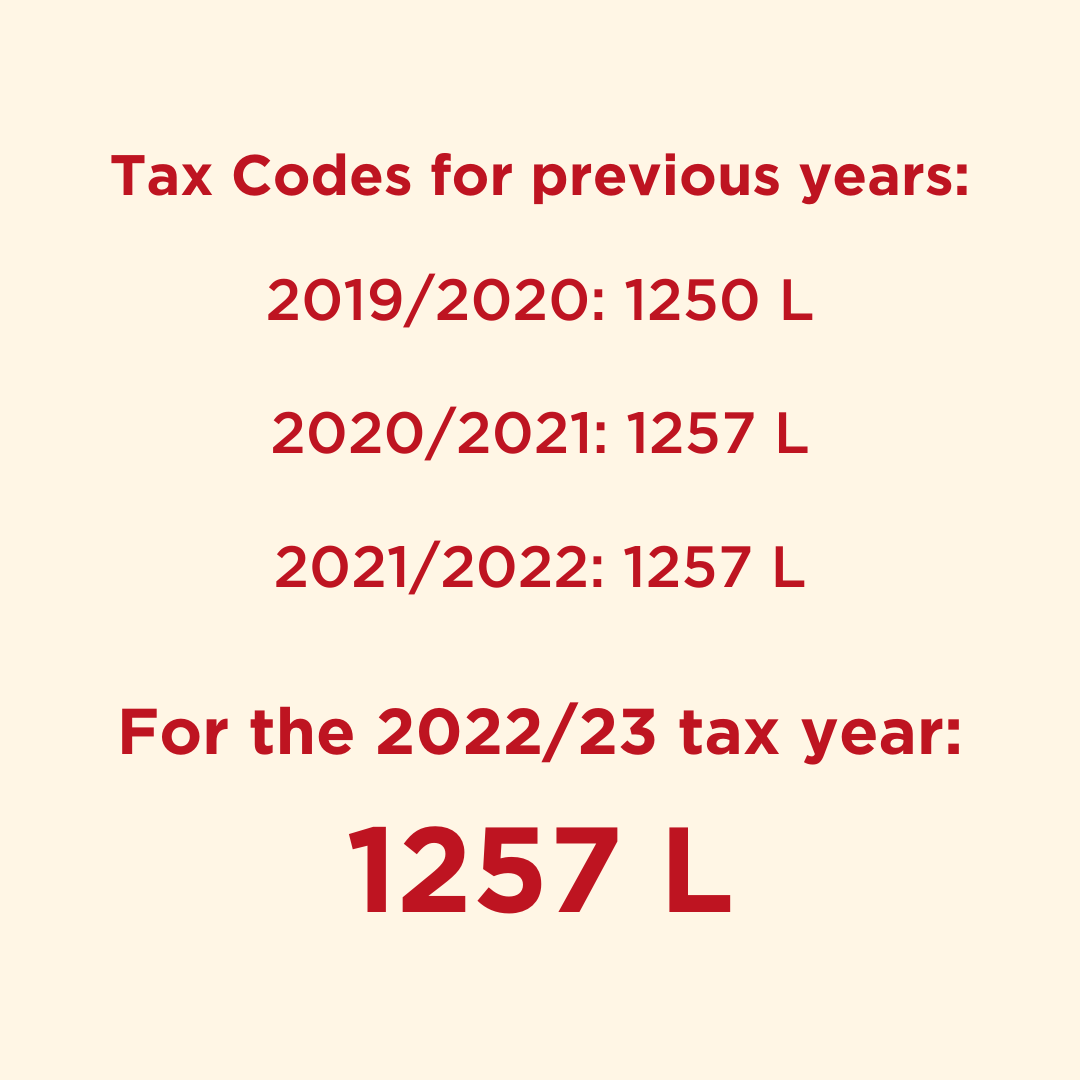

Others were worried about changes to tax codes. Your tax code should not change due to a refund claim but any problems with your tax code are covered in our aftercare service which means we will get any errors fixed for you at no extra charge. Read more about tax codes and how to check if yours is correct.

DIN ‘2015DIN01-005’ has been issued to all service personnel to officially confirm that tax refunds for travel are claimable.

It also states that you can use an agent to make a claim for you. RIFT will act as your agent, providing an end to end service if you don’t have the time or are not comfortable dealing with the technical legislation set out by HMRC.

This supports the previous formal confirmation we received from the Ministry of Defence.

Just like anyone else, you're entitled to a UK tax refund for travel expenses to and from temporary workplaces. If you're making your own way from a UK residence, you could have a pretty big refund on your hands. Watch out, though - if your family has moved abroad with you, then your main residence might be outside the UK. In that case, you can't claim for your travel costs.

Find out everything you need to know about paying UK tax if you work overseas or get in touch.

Yes, if this is classed as your main residence.

The legislation for tax refund claims is based on costs for travel expenses on to temporary postings of under 24 months, even outside the UK, using either your own vehicle or public transport counts.

If you're in the Armed Forces and making your own way to more than one base, you can claim any overpaid tax on the cost of that travel for the last 4 years, and the RIFT average 4 year rebate is £2,500.

HMRC takes a big enough bite out of your pay already. Don't let them hold onto cash that's supposed to be in your pocket. Use our tax calculator to find out if you are owed anything back.

No, laundry costs are included in your annual personal allowance (i.e. the amount you can earn tax-free each year). This will be recorded in your tax code.

You may be able to claim if you have the receipt and it is in the last four tax years as it is a work related expense.

Use our tax calculator to find out if you are due a refund.

Yes, the cost of flying varies considerably so we need evidence of your actual expenses for HMRC. We can only claim for the actual flights you made, not the cost of any flights between two destinations.

Have a look at our checklist of the documents or paperwork we'll need for your claim.

You can download all your wage slips from the JPAC website.

Under HMRC legislation a posting that is more than 24 months is deemed permanent and therefore the temporary workplace rules don’t apply. However, we would review every case in isolation as we would need to understand your expectation at the outset of your posting.

As you can claim for the previous 4 years even if you have been at your current base for over 24 months you may be able to claim for previous postings.

Use our Tax Calculator to work out if you are due a refund.

We need the following information to assess your MOD tax refund and then hopefully process your claim:

See our full document checklist and what to do if you are missing anything.

Other information – We’ll ask you a few simple questions about your financial circumstances e.g. if you have any other sources of income such as rental income, whether you have a student loan or a private pension that may affect your claim, your tax code or mean that you need to submit a self assessment tax return.

The MOD accommodation rules may also have an impact so we will need to understand your living arrangements. This helps us calculate the value of tax you’ve overpaid.

Use our Tax Calculator to find out if you are due money back.

Armed Forces uniform tax rebates are handled differently from most other professions. Generally speaking, your uniform maintenance costs are handled through your tax code. Basically, your tax-free Personal Allowance gets ratcheted up a few notches to make up for what you're shelling out.

Getting a specialist to do your tax return and refund means a load off. Any high street accountant will be expert at filling in tax returns. They may also offer you a guarantee that they’ll look after and take care of any queries, though this may be an extra cost.

As part of our Tax Refunds Service, we can complete your return AND we offer a full year’s aftercare.

Yes, no matter why you're leaving your job, you should get a P45.

Let’s start with your simple, beginner-level options for making money from home. They won’t get you rich quick, but they also don’t need any special skills.

Pick up people’s dry cleaning, mow their lawn. These kinds of odd jobs have been around for ages. But it’s now a digital marketplace - sites like TaskRabbit connect people who need odd jobs doing, with the people who are happy to do them. Some of this will require leaving the house - like picking up dry cleaning. But equally, it could be helping people with digital tasks - like helping write emails or making them a spreadsheet. So go check it out!

We’re not talking about life-changing money here but some companies will reward you for filling out surveys. It is that simple - give your opinion, get paid! You won’t even need a laptop for this one - you can easily do it on your phone.

Some people want their pets looked after in their own homes. But others will be happy to drop them at your place. There are a few well-known companies who’ll let you sign up online and then connect you digitally with pet owners - so get Googling!

If you’re just looking for some short-term funds, auction sites are a great place to start. Getting some unused items up for auction will also help you declutter your life, as well as giving you a short-term cash injection.

A lot of people like the idea of being their own boss, but don’t want to risk being self-employed as their only source of income. That’s how a lot of small businesses get their start, as second jobs for people who wok on the books elsewhere. This can be a great idea if you’re cut out for it, but you do need to keep your tax situation under control.

When you’re self-employed, even as a second job, you’ll need to get cosy with the taxman. That means registering yourself with HMRC as self-employed, getting set up for the Self Assessment system and filing yearly tax returns to report all your earnings, expenses and other key details.

Self Assessment comes with some specific dates and deadlines to hit, the most important of which is the 31st of January. Every year, this will be your deadline for filing your tax return paperwork, along with paying up what you owe.

The other thing to know before setting yourself up as self-employed is that your National Insurance Contributions (NICs) wont’ magically take care of themselves any more either. You’ll have to pay what you owe for these when you settle up with the taxman each year.

The basic paperwork for your self-employed job will be a little different from your on-the-books work, too. You won’t have a regular payslip sent to you, for one thing. That means you’ll have to keep a tight set of records covering all the money flowing into and out of your business. Self Assessment tax returns are a huge topic in themselves, so make sure you have a good understanding of what’s involved before diving in.

So, are you an on-the-books employee with a self-employed side gig or a small business owner who moonlights PAYE for someone else? Generally, it’s probably best to class your “main job” as the one that brings in the most money. Either way, you’ll be paying a year in arrears for your self-employed work. That means, for example, that the profits your self-employed business made in 2021/22 will factor into the eventual tax bill you’ll pay up by the 31st of January 2023. This is something that trips up a lot of people when they’re new to Self Assessment. Instead of the tax trickling out of your pay each month through the PAYE system, your self-employment tax for the entire year will all fall due in a big lump. Tax years run from the 6th of April to the 5th of the following April, though, so you’ll know 9 months ahead what you’ll have to cough up.

We all wish we could take home our entire salary. Unfortunately, that’s not the case. When working out your budget, it’s important to use your income after all deductions are taken out. That includes tax, national insurance, and pension contributions.

If you used your pre-tax salary, you’d end up with a number much larger than what actually goes into your bank account. That may look great on your spreadsheet, but it could lead to spending more money than you have.

The best way to look at your income is to add up all of the amounts on your payslips and divide it by the number of months they’re from. This way you’ll get an average that you can expect to take home each month.

For those with big differences in their pay, you may want to be a bit more cautious as some months may fall short of this figure. You might be best trying to save additional money from the higher paying months, so that you can make up the rest on the lower-paid months.

Yes! There are lots of everyday work expenses that entitle you to tax relief, but so many people just don't realise they qualify. Small tools from hairdressing scissors to masonry drills can count for a rebate claim, as can any required licences or professional subscriptions. This is a huge and often misunderstood area of tax law.

One of the biggest tax rebate issues is travel to temporary workplaces, but anything from visas to vaccinations can count. Understanding what you can claim for (and, just as importantly, what you can’t) is the key to maximising your tax refund claims while staying on HMRC’s good side.

Tax rebates are a really tricky area, which is why so many people decide to get professional help with them. The basic idea is that when you have to spend money to do your work, some of your costs can be used to bring down your tax bill. That said, the regulations are complicated, and you can get into serious trouble if you mess up. Not claiming back everything you’re owed is painful enough. Claiming too much is a whole lot worse once HMRC catches on.

There are a lot of reasons why you might be owed some tax back, but the main one is generally work expenses. Travel to temporary workplaces, repair and replacement of any essential gear and a whole range of other everyday costs can build up into a decent tax refund claim.

When HMRC works out the tax you owe, it assumes you’re working regularly throughout the year. If you’re a student doing casual or short-term work, though, you could end up paying too much tax. Basically, a holiday job could see you only being paid for a couple of months, but charged a whole year’s worth of tax. Worse yet, you’re probably still under your Personal Allowance for the year, so you shouldn’t have been taxed at all!

Luckily, whatever the reason you’ve paid too much, you can claim a tax rebate to settle up. You can generally check your tax and claim your refund online - but again, a lot of people prefer to get professional help. Claiming refunds properly means keeping track of a lot of paperwork, from the official documents you get from your employer to receipts and invoices for your expenses. You can find the official tax checker here: https://www.gov.uk/check-income-tax and the refund tool here: https://www.gov.uk/claim-tax-refund.

Like a lot of UK taxes, there’s a threshold you have to hit before you start owing anything on your capital gains. For the 2024/25 tax year, for instance, there’s a tax-free allowance of £3,000, or £1,500 for trusts. If your overall profit from disposing of assets ends up below this amount, you won’t pay any Capital Gains Tax on it.

If you’re married or in a civil partnership, then the rules for Capital Gains Tax have a little flexibility in them. In fact, unless you were separated and not living together at all during a tax year, you won’t pay any Capital Gains Tax if you “dispose of” an asset to them. At least, not unless you did it so their business could then sell it on.

Watch out, though – your spouse or civil partner could easily still get hit with Capital Gains Tax if they later dispose of the asset. If that happens, the rules work in the usual way. They’ll pay tax if they sell the asset, swap it, give it away or claim compensation for it. In this case, the profit they pay tax on will be based on the amount you originally paid for the asset, compared to the value they dispose of it for.

There’s another general exemption for Capital Gains Tax on items you give to charities. However, a wrinkle in the rules means that you could still have to pay CGT if you sell the item for less than its market value (but still make a profit compared to what you paid for it). Again, talk to a trusted professional if you’re not 100% sure whether you need to pay Capital Gains Tax or not.

Whatever kind of work they do, pretty much everyone dreams of being their own boss sometimes. Whether that means building an empire, or just putting one brick on top of another, it's about independence and freedom.

Right now in construction, we've got close to 100,000 self-employed workers. With almost 40,000 of those appearing in the last year, the government's actually kind of worried about it. In fact, they've been clamping down on certain kinds of self-employment with new rules and regulations.

What they're mostly bothered about is what they call "false self-employment". Basically, some firms were working a tax dodge by treating their employees as subcontractors when they really weren't. It was bad for HMRC, and worse for the workers. As well as ducking taxes, some of these "intermediaries" were avoiding responsibilities like employment rights and holiday pay.

The government's been cracking down on false self-employment in construction, but honestly they're flailing around a bit about it. That's lead to a bit of confusion.

There's good and bad about self-employment, obviously. You get some freedom and flexibility you might not otherwise have, that's true. You've also got a load of new responsibilities, too. You need to file your own Self Assessment tax returns, for one thing. Also, you can say goodbye to job security, sick pay and your workplace pension. It's a swings-and-roundabouts thing.

Read our guide to CIS and Self-Assessment

Another consideration is that working for yourself can easily turn into working for nobody. There's always competition out there, and you really need to promote yourself to get work. You can't count on clients to magically trust you - or even to know you exist!

Along with the challenge, though, there's always opportunity. Experts are warning the construction industry's facing a "skills time bomb". There just aren't enough highly skilled workers coming up through apprenticeships and training schemes. Demand's booming, but we're running out of workers. You might well find that a specialised skill you have is the ticket to a whole new corner of the market.

If you're already self-employed, or looking to go that route, get in touch with RIFT. We're experts in construction and know the terrain like no one else. From tax refunds to Self Assessment returns, we're here to help you build your dream job.

Once you've set your Marriage Allowance up, you don't need to apply again unless your situation changes. Obviously, getting divorced means you can no longer make a Marriage Allowance claim, for example. The death of either partner will do the same, naturally enough. You can even cancel it yourself if you need to for any reason.

Since there are income thresholds involved, a change in either your earnings or your partner’s can also affect your Marriage Allowance claim. For example, if you suddenly start making more than your Personal Allowance, you won’t have any extra to transfer to your spouse or partner. In the same way, if you find yourself bumped into a higher tax bracket, you no longer qualify to receive Marriage Allowance at all. When something changes in your circumstances and you’re not sure if you still qualify for (or benefit from) the Marriage Allowance scheme, talk to RIFT tax refunds to keep yourself on the right track.

Yes, you can claim your tax rebate online by logging into the gov.uk site with your Government Gateway User ID and password. If you don’t already have one of these, you can set one up, which should only take a few minutes if you’ve got your National Insurance number and a recent payslip, a P60 or a valid UK passport to hand.

You’ll need to show HMRC some proof of all the work expenses you’re claiming a tax refund for. You’ll also need a few bits of crucial information, like details of the places you’ve worked in the years you’re claiming for. There are a lot of complicated rules about which kinds of expenses can earn you a tax refund, so talk to RIFT if you’re not 100% sure where you stand.

The taxman likes to be kept up to date on any income you’re earning, but he’s not some crazed stalker prying into every aspect of your private life. Gifts from your parents or friends, student loans and grants don’t count as taxable income in HMRC’s eyes. The same goes for bursaries, scholarships and so on.

Yes. If you’re renting out a room while you’re studying, then the taxman will want his bite of it. As always, any Personal Allowance you’re entitled to applies. You’ll probably end up filing Self Assessment tax returns to account for the income. However, depending on what you’re renting out, you might be able to use the Rent a Room scheme. Under Rent a Room, you can earn up to £7,500 tax-free a year from renting out furnished accommodation in your main home. Rent a Room is simpler for most people than working out their expenses in their tax returns. As long as you qualify for it, it can be a decent way to score some extra income.

Visit our guide to tax on rental income.

Apprenticeships are a lot like training contracts, in that you’re working primarily to learn a trade or set of skills. However, apprenticeships are paid positions. That means you’ll be taxed through the PAYE system. Depending on how long your apprenticeship lasts, you might find yourself claiming back some PAYE tax from HMRC (if it’s less than a full year, for instance). Also, unless your employer’s paying or reimbursing all your expenses (travel to temporary workplaces, tool/equipment repair, and so on), you might be owed some tax back for those, too.

If your student job’s the first toe you’ve dipped into the taxman’s world, there’s a potentially nasty trap you need to watch out for. If HMRC doesn’t have enough information to issue you a PAYE tax code, your employer might lump you with an emergency one such as 500 0t or X. In practice, it’s not really as bad as it sounds. It just means you’ll only be entitled to your basic Personal Allowance. For most people, that’s all they’d probably get anyway. However, an emergency code is bad news if you ought to be getting any allowances or tax reliefs - like the Blind Person’s Allowance, just to pick an example.

Tax breaks are another term for tax relief. HMRC has various systems in place to help people and businesses bring down the tax they're paying under certain circumstances. For example, when you're reaching into your own pocket for things like travel to temporary workplaces, you can claim back some tax on your mileage expenses. Everything from individuals washing their work uniforms to businesses conducting cutting-edge R&D can qualify for some kind of tax relief. The key to getting the best from these systems is to know exactly what you qualify for, and how to claim it back.

If you're self-employed and paid through the Construction Industry Scheme (CIS), you're probably due a tax refund.

You can also claim back a range of job-related expenses, including travel, meals, lodging, parking, tolls, tools, protective clothing, public liability insurance, phone bills, postage and stationery.

We’ll assess all your expenses and include them if they qualify. That way you'll be certain that everything on your claim is a genuinely allowable expense and you won't find HMRC knocking on your door asking for their money back. If you're a RIFT customer, you'll be covered by our RIFT Guarantee as well, so you've got even more peace of mind.

Sadly there are a number of unscrupulous tax refund advisors taking advantage of CIS workers at the moment.

If you want to see how much you could be due back from HMRC use our CIS Tax Calculator and find out in seconds.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

Read our guide to CIS and Self-Assessment

Yes it does. All self-employed people, including CIS workers, have to complete a tax return every year. The tax year ends on 5th April and you’ve got until 31st January the following year to send your tax return to HMRC.

Read more about Tax and the Construction Industry Scheme

At RIFT we complete your tax return for you, and claim your tax refund at the same time. Just tell us where you’ve worked, and when, and we’ll work out the cost of your travel. We’ll add any other job-related expenses you may have and fill in the tax forms for you, all you need to do is sign them.

We’ll send the forms to HMRC, handle any questions on your behalf and chase them if they don’t pay out in the agreed timescale – it’s all part of our service.

95% of our CIS customers get a tax refund, and the average value of the refunds is £1,705 per year.

Read our guide to CIS and Self-Assessment

Use our CIS tax calculator to find out how much you could have waiting for you at HMRC.

CIS tax rebates generally take about 4-10 weeks for HMRC to process. RIFT’s CIS refund service includes handling your Self Assessment CIS tax return and full aftercare throughout the year, with no hidden prices. With RIFT, you get the very best from your claim, as fast as possible and with no expensive hourly rates to cough up. One simple fee takes care of everything.

HMRC’s not known for its blistering speed, but there are a few things you can do to keep the wheels turning on your claim:

RIFT’s expert teams will make sure there's no hold-up at HMRC. That means no endless waits on HMRC helplines and no dangerous mistakes creeping into your claim. We'll even chase up old employers if they're dragging their feet in sending the information we need. Once you’re happy with the amount we’ve calculated for your rebate, we’ll chase up HMRC until it’s paid out in full. Meanwhile, we take expert care of you all year round, and we’re never more than an email or phone call away. As always, everything's covered by our RIFT Guarantee. As long as you've given us complete and accurate information, your rebate is protected.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

When you file your own Self Assessment tax returns, it's easy to miss out on CIS claims or make costly mistakes. Under the CIS scheme, your employer takes tax directly from your pay before you get it. This almost always means you're instantly losing 20% to the taxman. As a result, you’ll probably find you’ve been overcharged by HMRC when you file your Self Assessment tax return.

It takes specialist understanding to claim tax back for CIS construction workers. Every year, far too many people are still shelling out tax they don't owe. In the worst-case scenario, they don’t get any CIS tax rebate at all. Even if they do, it’s often nowhere near as much as they deserve.

Yes! All self-employed people, including CIS workers, have to complete a yearly Self Assessment return. The tax year runs until on 5th April, then you've got until the following 31st of January to complete and file your tax return.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

Read our guide to CIS and Self-Assessment

With RIFT, filing and completing your CIS tax return is all part of our tax rebate service. Armed with a list of your workplaces for the year and a few more details, we'll work out the cost of your travel and what you’re owed for it. Next, we'll add any other essential expenses you’ve had and sort out your paperwork.

We'll send the forms to HMRC, handle any questions on your behalf and keep chasing the taxman until your rebate’s paid. 95% of our CIS customers get a tax refund, with an average value of over £1,705 per year.

The taxman really doesn’t like waiting. Miss the filing or payment deadline by a single day and you'll get an immediate £100 penalty. At 2 months late, that fine doubles. At 6 and 12 months late, it reaches £300 (or 5% of the CIS deductions on the return, if that's higher). Any longer and you might face an additional penalty of £3,000, or 100% of the CIS deductions on the return.

Of course, with RIFT on your team, you’ve got nothing to worry about. We’ll keep you in the taxman's good books and make sure you never miss out on your CIS tax claims - even the ones you didn’t know you qualified for!

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

You’ll need a few bits of information about yourself to register for the Construction Industry Scheme:

The CIS scheme covers most of the construction work done in the UK. If you’re self-employed in the building trade, you’ll almost certainly have to register for it. Contractors will need to verify their subcontractors, handle their CIS deductions and file monthly CIS returns.

If you’re a subcontractor and don’t sign up for CIS, it doesn’t mean you won’t have the deductions taken from your pay. In fact, you’ll probably actually lose even more of your money, since the rate goes up to 30% for people who aren’t CIS-registered. It’s possible that you qualify for “gross payment” status, where you don’t have to pay CIS deductions. Don’t count on that, though, as there are specific rules and conditions to meet.

One of the problems with CIS is that it's very easy to end up paying too much - and you won't get an automatic refund. To claim your CIS rebate, HMRC demands proof of what you’re owed. This is what RIFT Tax Refunds is all about, so get in touch to see how we can help.

If you are currently working PAYE (on the books) and need to switch to CIS we can help you.

Remember that CIS covers all UK construction work, even if it's done by foreign firms. There are penalties for filing late, so you have to stay on top of the paperwork.

Find out more about the how to register for CIS if you need to.

When you register with the Construction Industry Scheme, you get a card. The kind you’re given depends on your situation:

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

For most general contractors in the UK building trade, the CIS scheme's compulsory. It includes everything from site preparation and repairs to decoration and demolition. There are a few exceptions, though. For instance, if you’re a contractor who only deals with very limited sections of the work (like carpet fitting), you may not have to register.

Find out more about the how to register and who needs to.

CIS covers all construction work done in the UK, even when it's done by foreign firms. The registration system is a little different, but all the basic rules are the same. The UK has some ''double taxation'' agreements in place with various other countries to reduce your total tax when you're paying in both countries. Talk to RIFT if you need help working out what it all means for you.

Read our guide to CIS and Self Assessment

The standard Construction Industry Scheme tax deduction is 20%. If that sounds like HMRC's taking a huge lump out of your pay, then it only gets worse if you don’t sign up to the scheme. If you haven’t registered, the rate shoots up to 30%! This can also happen if you don't give your employer your Unique Taxpayer Reference number (UTR). Your UTR is used by HMRC to identify you. If your employers don't have it, the taxman might assume you aren't registered for CIS and charge you the higher rate.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

CIS tax deductions are payments your employer takes out of your wages before you get them. Those payments go straight to HMRC instead of you. They're supposed count as advance payments toward your tax and National Insurance, clamping down on tax evasion in the industry. Unfortunately, one of the side-effects of CIS is that a lot of honest people end up being charged too much tax. At RIFT, our friendly teams of CIS experts can quickly tell you if you're due a tax rebate, then make sure you get it.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

A Construction Industry Scheme Payment and Deduction statement is a record of the money you've been paid and taxed on if you work under the CIS scheme. You might also just call them wage slips, payslips or something similar.

If you're self-employed in construction, they're some of the most important documents you'll ever have. When you file your yearly CIS tax return, you'll need these statements to prove what you've earned and paid. You should get a CIS Payment and Deduction statement from your boss whenever you’re paid, within 14 days of the end of the tax month.

The main thing you'll need your CIS certificates or wage slips for is filing your yearly Self Assessment tax returns. The taxman will expect you to show him a record of all the cash you’ve got coming in. With the CIS taking 20% of your pay before you get it, you’re probably not getting the full benefit of your tax-free Personal Allowance. You’ll be hard-pressed to prove that without your CIS paperwork to back up your claim, though.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

Read our guide to CIS and Self-Assessment

Employment status is a huge issue in construction, and it can get very complicated with so many layers of contractors, subcontractors, agencies and so on. You might think you’re working under exactly the same conditions as your PAYE workmates, but the taxman could well take a different view.

The first thing to do is check your payslips. If they say “CIS statement” and show 20% deductions being made, then you’re being taxed through CIS. If that seems wrong, you need to talk to your employer fast.

The CIS scheme is only for construction, and its rules can catch out even experienced self-employed people from other industries. If you’ve got self-employed mates from outside of construction, be careful taking Self Assessment advice from them. They might not know the territory as well as they think they do. Play it safe and talk to the experts at RIFT instead.

In construction, a contractor is a person or business supplying materials or labour for a job. On the other hand, a subcontractor is anyone who does construction work for a contractor. Basically, according to HMRC, you're a contractor if you pay subcontractors for construction work.

You can also count as a construction contractor if your business doesn't do construction work, but still spends an average of over £1m a year on construction in any 3-year period. Either way, you’ll need to register for CIS and start taking deductions from your subcontractors’ pay.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

Start My Claim

As a contractor, you need to register for CIS before you even take on your first subcontractor. You're going to have a lot of responsibilities under the scheme, so get used to minding the details. Here's what you need to do:

Subcontractor tax refunds can be tricky. It’s easy to miss out on money you’re owed - or even get put off from claiming altogether. Even pricey accountants can find themselves tangled up in the system if they don't know the construction industry well. RIFT Tax Refunds has been specialising in construction rebates since 1999. There really are no safer hands to be in.

Gross payment status means that no CIS deductions get taken out of your pay. There are 3 basic tests to see if you qualify:

Yes, you will pay tax “at source” (your tax is taken off your wages before you get them), most likely at the rate of 20% of your income.

However, this doesn’t mean you are “employed”. You still count self-employed under CIS – even if it doesn’t feel like it. The big difference is that this means you'll still have to do Self Assessment each year. Not filing those tax returns each year brings three very serious problems your way:

If you're getting CIS statements and don't understand why, get in touch with RIFT straight away. We can explain the system, make sure you aren't paying too much tax and keep you out of trouble with HMRC.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

There are strict rules for CIS contractors about payment and deduction statements. They need to send you one every time you're paid, with specific deadlines to hit.

If you haven't been receiving yours, don't panic. It may just be a simple admin mix-up. Get in touch with your contractor and ask for your certificates, so you can keep your Self Assessment records up-to-date.

Don't just ignore the problem. If it turns out your contractor's not been doing things correctly with HMRC, things could get awkward for you in a hurry, come the end of the tax year.

You will need the statements to submit your tax return, read our guide to CIS and Self-Assessment

If you still have no luck, come to RIFT for advice and help. We're experts in sorting out tax problems for UK construction, and we'll get straight to work.

If you're self-employed in any kind of business, you'll almost certainly be using Self Assessment to pay your tax. In the construction industry, you'll probably also have to deal with the Construction Industry Scheme (CIS). Subcontracting under CIS means your Self Assessment filing has a couple of extra points to consider. If you don't understand the system, it's easy to end up paying a lot of extra tax you don't owe. If you think you are due a tax rebate check out our CIS tax refund pages.

Self-employed CIS workers can sometimes pass work on to other people. However, there are strict rules about doing this, and breaking them can lead to serious trouble. HMRC has a real problem with people in CIS work paying cash-in-hand for others to do jobs for them. It doesn't matter if you're passing the work on to friends, colleagues or family. You still have to follow the rules.

Read more about the Construction Industry Scheme (CIS) and how to register if you need to.

The first thing to know is that passing your CIS work on makes you a contractor in HMRC's eyes. That means you have to register yourself to avoid serious trouble from the taxman. You can't just slip someone a fistful of banknotes on the sly and sort things out later. You need get yourself registered before you take on your first subcontractor.

After that, you need to be sure your subcontractors are signed up for CIS. When you pay your subcontractors, you have to take CIS deductions from their pay and send them to the taxman. You'll also need to file returns every month and keep detailed CIS records. If you slip up, or ignore the regulations altogether, you're looking at some painful penalties.

Find out more about the Construction Industry Scheme (CIS) and how to register if you need to.

As long as you're following the rules, then the cash you're paying the people you give the work to counts as an expense. That means it will bring down the amount of profit you're paying tax on. If RIFT is handling your tax returns, of course, we'll handle all of this for you as part of the service.

If you've been passing some of your CIS work on, then you need to have good records to show the taxman. HMRC will expect to see detailed evidence of the wages you've paid out, for instance. In addition, they'll also want to see the details of the people doing the work for you. Names, addresses and their Unique Taxpayer Reference numbers will all be needed. Again, RIFT will handle all the sticky HMRC business for you to keep you within the regulations and out of trouble.

RIFT was first founded to help construction workers tackle the taxman. We've grown a lot since then, but we always remember where we started. We're still the leading experts on taking care of the UK's construction industry. We're on great terms with HMRC, and know the business inside and out. Whatever tax problems or questions you've got, talk to RIFT.

Read more about the Construction Industry Scheme (CIS) and how to register if you need to.

The first thing to understand about healthcare tax refunds is that not every mile you travel or pound you spend will count toward your claim. A daily commute to a permanent workplace, for example, won’t earn you any tax relief. To qualify for a refund, your work travel needs to be to and from what HMRC calls “temporary workplaces”. In practice, this generally means anywhere you work for less than 24 months. So, for example, a nursing job that requires you to travel out to patients’ homes could end up making you eligible for a pretty decent tax refund. Meanwhile, travel expenses can also include some subsistence costs while you're on the move. Things like accommodation and food can all contribute toward your claim.

There are also a few tricky points to consider. If you're travelling to a number of hospitals or clinics within the same general area, with your mileage and travel times not changing much, HMRC might consider the entire region your “permanent workplace”. It's always best to get professional advice in situations like these.

Rotational contracts, where you're working full-time at a series of hospitals over a period of years usually won't qualify. However, if your training takes place under, for example, a single 5-year contract, then things changes. In that case, each hospital you work at will count as temporary because it's a single employment with multiple temporary workplaces. The regulations are easy to trip over here, so it's often a good idea to get professional help.

If you're already getting some of your costs reimbursed by your employer, you may still be owed tax back. HMRC has set rates for Approved Mileage Allowance Payments (AMAP), and if you're not getting the full amount you can claim back the difference. The NHS has its own rates as well, if you're employed by them.

Beyond travel, there are several more ways a job in healthcare can cost you money. If you’re paying out of your own pocket for repair, replacement or even laundry of your work uniform, for instance, you could make a claim for those costs. The same goes for union dues and professional body fees to organisations like the Nursing and Midwifery Council.

The key points to remember are that the costs you’re claiming tax relief for need to be essential to your work, and you need to be paying them yourself. In addition, to get back everything you’re owed you’ll need to show proof of what you’re spending. That means records and receipts – although the simplified Flat Rate Expenses system can offer an easier way if you don’t mind sticking to HMRC’s figures.

If you find yourself buying things like laptops or office equipment for work use, you might have a claim under HMRC’s capital allowances system. This is generally for items that you’ll be using for a couple of years or more – and again, you’ll need to be footing the bill yourself for them to qualify for tax relief.

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

North East | NE | £1,563,741,000 | £102,823,000 | 7.0%

Durham | NE | £331,812,000 | £33,270,000 | 11.1%

Northumberland | NE | £234,062,000 | £14,607,000 | 6.7%

Newcastle upon Tyne | NE | £147,544,000 | £9,051,000 | 6.5%

Sunderland | NE | £131,683,000 | £8,754,000 | 7.1%

North Tyneside | NE | £123,451,000 | £5,878,000 | 5.0%

Stockton-on-Tees | NE | £122,418,000 | £6,867,000 | 5.9%

Gateshead | NE | £112,816,000 | £3,977,000 | 3.7%

Redcar & Cleveland | NE | £82,730,000 | £3,098,000 | 3.9%

South Tyneside | NE | £77,294,000 | £4,405,000 | 6.0%

Middlesbrough | NE | £75,880,000 | £5,102,000 | 7.2%

Darlington | NE | £69,986,000 | £4,199,000 | 6.4%

Hartlepool | NE | £54,065,000 | £3,615,000 | 7.2%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

North West | NW | £4,425,938,000 | £241,981,000 | 5.8%

Cheshire East | NW | £311,868,000 | £12,117,000 | 4.0%

Cheshire West and Chester | NW | £259,808,000 | £12,325,000 | 5.0%

Liverpool | NW | £241,128,000 | £20,359,000 | 9.2%

Manchester | NW | £235,228,000 | £18,078,000 | 8.3%

Stockport | NW | £208,598,000 | £9,410,000 | 4.7%

Wirral | NW | £195,815,000 | £7,764,000 | 4.1%

Sefton | NW | £181,909,000 | £8,306,000 | 4.8%

Wigan | NW | £164,600,000 | £13,419,000 | 8.9%

Salford | NW | £153,869,000 | £12,525,000 | 8.9%

Bolton | NW | £152,991,000 | £9,010,000 | 6.3%

Trafford | NW | £139,577,000 | £7,344,000 | 5.6%

Warrington | NW | £137,182,000 | £6,472,000 | 5.0%

Tameside | NW | £125,931,000 | £6,393,000 | 5.3%

Oldham | NW | £121,575,000 | £6,351,000 | 5.5%

Rochdale | NW | £118,760,000 | £5,743,000 | 5.1%

Bury | NW | £117,378,000 | £5,465,000 | 4.9%

St Helens | NW | £104,424,000 | £4,630,000 | 4.6%

South Lakeland | NW | £95,173,000 | £2,978,000 | 3.2%

Preston | NW | £87,557,000 | £6,923,000 | 8.6%

Lancaster | NW | £86,973,000 | £5,202,000 | 6.4%

Wyre | NW | £81,051,000 | £4,116,000 | 5.3%

Chorley | NW | £78,342,000 | £4,211,000 | 5.7%

Blackpool | NW | £78,115,000 | £6,145,000 | 8.5%

West Lancashire | NW | £76,724,000 | £5,700,000 | 8.0%

South Ribble | NW | £76,615,000 | £4,346,000 | 6.0%

Knowsley | NW | £75,220,000 | £5,013,000 | 7.1%

Blackburn with Darwen | NW | £74,232,000 | £4,830,000 | 7.0%

Carlisle | NW | £71,951,000 | £2,649,000 | 3.8%

Halton | NW | £69,642,000 | £2,147,000 | 3.2%

Fylde | NW | £66,260,000 | £3,981,000 | 6.4%

Allerdale | NW | £64,957,000 | £2,353,000 | 3.8%

Pendle | NW | £55,429,000 | £2,412,000 | 4.5%

Ribble Valley | NW | £50,350,000 | £2,519,000 | 5.3%

Burnley | NW | £49,929,000 | £2,448,000 | 5.2%

Hyndburn | NW | £44,674,000 | £1,710,000 | 4.0%

Rossendale | NW | £44,165,000 | £2,183,000 | 5.2%

Copeland | NW | £43,584,000 | £1,644,000 | 3.9%

Eden | NW | £43,468,000 | £1,448,000 | 3.4%

Barrow-in-Furness | NW | £40,886,000 | £1,312,000 | 3.3%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

Yorkshire and the Humber | YH | £3,180,396,000 | £152,338,000 | 5.0%

Leeds | YH | £433,854,000 | £22,147,000 | 5.4%

Sheffield | YH | £297,955,000 | £15,511,000 | 5.5%

Bradford | YH | £264,461,000 | £10,931,000 | 4.3%

East Riding of Yorkshire | YH | £248,126,000 | £15,039,000 | 6.5%

Kirklees | YH | £238,666,000 | £9,405,000 | 4.1%

Wakefield | YH | £194,845,000 | £11,345,000 | 6.2%

Doncaster | YH | £153,988,000 | £8,379,000 | 5.8%

Rotherham | YH | £147,804,000 | £5,696,000 | 4.0%

Harrogate | YH | £137,958,000 | £7,221,000 | 5.5%

Barnsley | YH | £132,483,000 | £7,902,000 | 6.3%

York | YH | £127,834,000 | £5,909,000 | 4.8%

Calderdale | YH | £122,350,000 | £3,411,000 | 2.9%

Kingston upon Hull | YH | £119,815,000 | £4,394,000 | 3.8%

North Lincolnshire | YH | £99,722,000 | £3,419,000 | 3.6%

North East Lincolnshire | YH | £93,334,000 | £3,089,000 | 3.4%

Scarborough | YH | £84,679,000 | £4,479,000 | 5.6%

Hambleton | YH | £76,646,000 | £3,874,000 | 5.3%

Selby | YH | £68,511,000 | £2,853,000 | 4.3%

Craven | YH | £49,080,000 | £3,305,000 | 7.2%

Ryedale | YH | £47,042,000 | £2,356,000 | 5.3%

Richmondshire | YH | £41,243,000 | £1,673,000 | 4.2%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

West Midlands | WM | £3,410,079,000 | £159,844,000 | 4.9%

Birmingham | WM | £449,767,000 | £16,990,000 | 3.9%

Shropshire | WM | £233,000,000 | £11,623,000 | 5.3%

Coventry | WM | £181,836,000 | £10,228,000 | 6.0%

Dudley | WM | £165,453,000 | £9,760,000 | 6.3%

Walsall | WM | £154,444,000 | £6,270,000 | 4.2%

Herefordshire | WM | £149,003,000 | £5,446,000 | 3.8%

Solihull | WM | £140,819,000 | £7,395,000 | 5.5%

Sandwell | WM | £139,707,000 | £12,795,000 | 10.1%

Wolverhampton | WM | £135,070,000 | £8,522,000 | 6.7%

Stratford-on-Avon | WM | £122,289,000 | £7,062,000 | 6.1%

Stoke-on-Trent | WM | £119,263,000 | £5,878,000 | 5.2%

Warwick | WM | £117,282,000 | £5,966,000 | 5.4%

Telford & Wrekin | WM | £103,417,000 | £4,434,000 | 4.5%

Wychavon | WM | £98,673,000 | £2,514,000 | 2.6%

Stafford | WM | £93,386,000 | £3,183,000 | 3.5%

Nuneaton & Bedworth | WM | £82,965,000 | £3,786,000 | 4.8%

Rugby | WM | £81,847,000 | £3,961,000 | 5.1%

East Staffordshire | WM | £78,565,000 | £4,659,000 | 6.3%

Lichfield | WM | £78,378,000 | £3,388,000 | 4.5%

South Staffordshire | WM | £76,557,000 | £3,540,000 | 4.8%

Bromsgrove | WM | £75,495,000 | £3,401,000 | 4.7%

Newcastle-under-Lyme | WM | £73,540,000 | £2,989,000 | 4.2%

Wyre Forest | WM | £68,296,000 | £2,990,000 | 4.6%

Staffordshire Moorlands | WM | £66,014,000 | £1,729,000 | 2.7%

Malvern Hills | WM | £62,389,000 | £1,666,000 | 2.7%

Worcester | WM | £61,302,000 | £1,113,000 | 1.8%

Cannock Chase | WM | £58,656,000 | £2,282,000 | 4.0%

Redditch | WM | £52,587,000 | £2,188,000 | 4.3%

North Warwickshire | WM | £45,586,000 | £2,200,000 | 5.1%

Tamworth | WM | £44,493,000 | £1,886,000 | 4.4%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

East Midlands | EM | £3,049,500,000 | £150,425,000 | 5.2%

West Northamptonshire | EM | £289,141,000 | £14,760,000 | 5.4%

North Northamptonshire | EM | £226,861,000 | £10,005,000 | 4.6%

Leicester | EM | £159,025,000 | £8,441,000 | 5.6%

Nottingham | EM | £156,955,000 | £6,503,000 | 4.3%

Derby | EM | £133,076,000 | £5,462,000 | 4.3%

Charnwood | EM | £117,407,000 | £4,340,000 | 3.8%

Rushcliffe | EM | £99,637,000 | £5,602,000 | 6.0%

South Kesteven | EM | £93,292,000 | £8,544,000 | 10.1%

Newark & Sherwood | EM | £91,616,000 | £4,006,000 | 4.6%

East Lindsey | EM | £89,018,000 | £5,209,000 | 6.2%

Gedling | EM | £82,395,000 | £4,018,000 | 5.1%

Amber Valley | EM | £82,316,000 | £3,653,000 | 4.6%

Bassetlaw | EM | £81,768,000 | £5,139,000 | 6.7%

Hinckley & Bosworth | EM | £78,061,000 | £3,255,000 | 4.4%

Harborough | EM | £77,561,000 | £4,043,000 | 5.5%

Broxtowe | EM | £75,749,000 | £4,172,000 | 5.8%

North Kesteven | EM | £75,626,000 | £4,305,000 | 6.0%

Ashfield | EM | £74,379,000 | £3,551,000 | 5.0%

North West Leicestershire | EM | £73,219,000 | £3,793,000 | 5.5%

South Derbyshire | EM | £72,999,000 | £3,487,000 | 5.0%

Blaby | EM | £70,546,000 | £2,520,000 | 3.7%

North East Derbyshire | EM | £67,039,000 | £3,577,000 | 5.6%

Erewash | EM | £66,407,000 | £3,331,000 | 5.3%

Mansfield | EM | £65,354,000 | £2,769,000 | 4.4%

West Lindsey | EM | £63,739,000 | £4,148,000 | 7.0%

High Peak | EM | £63,031,000 | £1,994,000 | 3.3%

Derbyshire Dales | EM | £60,997,000 | £1,772,000 | 3.0%

Chesterfield | EM | £58,230,000 | £3,120,000 | 5.7%

South Holland | EM | £57,050,000 | £3,361,000 | 6.3%

Lincoln | EM | £49,046,000 | £2,993,000 | 6.5%

Bolsover | EM | £47,531,000 | £2,271,000 | 5.0%

Melton | EM | £39,559,000 | £1,379,000 | 3.6%

Boston | EM | £38,700,000 | £1,739,000 | 4.7%

Rutland | EM | £36,086,000 | £1,779,000 | 5.2%

Oadby & Wigston | EM | £36,084,000 | £1,384,000 | 4.0%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

South West | SW | £4,170,619,000 | £204,197,000 | 5.1%

Cornwall | SW | £428,164,000 | £23,547,000 | 5.8%

Wiltshire | SW | £401,770,000 | £17,246,000 | 4.5%

Dorset | SW | £347,595,000 | £14,396,000 | 4.3%

Bournemouth, Christchurch & Poole | SW | £288,013,000 | £20,677,000 | 7.7%

Bristol | SW | £282,731,000 | £17,962,000 | 6.8%

South Gloucestershire | SW | £206,164,000 | £12,051,000 | 6.2%

North Somerset | SW | £157,456,000 | £7,016,000 | 4.7%

Swindon | SW | £150,055,000 | £7,231,000 | 5.1%

Plymouth | SW | £149,024,000 | £5,416,000 | 3.8%

East Devon | SW | £131,472,000 | £5,684,000 | 4.5%

Bath & North East Somerset | SW | £130,664,000 | £4,488,000 | 3.6%

South Somerset | SW | £124,764,000 | £7,644,000 | 6.5%

Somerset West & Taunton | SW | £113,682,000 | £5,014,000 | 4.6%

Teignbridge | SW | £108,453,000 | £4,637,000 | 4.5%

Stroud | SW | £95,358,000 | £3,191,000 | 3.5%

Torbay | SW | £94,708,000 | £3,307,000 | 3.6%

Mendip | SW | £87,093,000 | £3,562,000 | 4.3%

South Hams | SW | £86,517,000 | £3,518,000 | 4.2%

Sedgemoor | SW | £86,095,000 | £5,107,000 | 6.3%

Cheltenham | SW | £85,410,000 | £2,596,000 | 3.1%

Cotswold | SW | £83,351,000 | £5,529,000 | 7.1%

Exeter | SW | £78,786,000 | £2,882,000 | 3.8%

North Devon | SW | £77,785,000 | £3,832,000 | 5.2%

Gloucester | SW | £73,896,000 | £2,565,000 | 3.6%

Tewkesbury | SW | £70,059,000 | £3,843,000 | 5.8%

Mid Devon | SW | £66,171,000 | £3,210,000 | 5.1%

Forest of Dean | SW | £62,009,000 | £3,181,000 | 5.4%

Torridge | SW | £53,044,000 | £2,188,000 | 4.3%

West Devon | SW | £48,269,000 | £2,559,000 | 5.6%

Isles of Scilly | SW | £2,061,000 | £118,000 | 6.1%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

South East | SE | £7,100,340,000 | £385,495,000 | 5.7%

Buckinghamshire UA | SE | £476,884,000 | £34,979,000 | 7.9%

Brighton and Hove | SE | £191,558,000 | £7,849,000 | 4.3%

Milton Keynes | SE | £181,164,000 | £11,932,000 | 7.1%

Medway | SE | £167,634,000 | £8,183,000 | 5.1%

Wokingham | SE | £155,860,000 | £6,423,000 | 4.3%

Wealden | SE | £150,633,000 | £6,611,000 | 4.6%

New Forest | SE | £144,290,000 | £5,034,000 | 3.6%

Elmbridge | SE | £142,689,000 | £7,513,000 | 5.6%

Maidstone | SE | £138,907,000 | £7,964,000 | 6.1%

Reigate & Banstead | SE | £136,732,000 | £10,904,000 | 8.7%

West Berkshire | SE | £132,930,000 | £6,933,000 | 5.5%

South Oxfordshire | SE | £132,912,000 | £7,935,000 | 6.3%

Mid Sussex | SE | £130,908,000 | £6,659,000 | 5.4%

Horsham | SE | £129,545,000 | £4,923,000 | 4.0%

Guildford | SE | £128,587,000 | £9,818,000 | 8.3%

Arun | SE | £128,561,000 | £5,224,000 | 4.2%

Basingstoke & Deane | SE | £127,920,000 | £5,399,000 | 4.4%

Southampton | SE | £127,865,000 | £4,403,000 | 3.6%

Waverley | SE | £126,199,000 | £6,490,000 | 5.4%

Cherwell | SE | £125,460,000 | £8,497,000 | 7.3%

Reading | SE | £122,437,000 | £6,201,000 | 5.3%

Vale of White Horse | SE | £122,351,000 | £8,263,000 | 7.2%

Isle of Wight | SE | £114,625,000 | £5,055,000 | 4.6%

Chichester | SE | £111,057,000 | £4,674,000 | 4.4%

Portsmouth | SE | £109,249,000 | £7,726,000 | 7.6%

Sevenoaks | SE | £109,170,000 | £3,767,000 | 3.6%

Tonbridge & Malling | SE | £108,816,000 | £5,252,000 | 5.1%

Windsor & Maidenhead | SE | £106,251,000 | £5,342,000 | 5.3%

Canterbury | SE | £105,237,000 | £5,470,000 | 5.5%

Oxford | SE | £102,162,000 | £6,259,000 | 6.5%

East Hampshire | SE | £101,202,000 | £4,307,000 | 4.4%

Winchester | SE | £101,104,000 | £5,424,000 | 5.7%

West Oxfordshire | SE | £98,635,000 | £8,696,000 | 9.7%

Test Valley | SE | £98,567,000 | £4,457,000 | 4.7%

Eastleigh | SE | £97,134,000 | £7,362,000 | 8.2%

Ashford | SE | £96,516,000 | £4,804,000 | 5.2%

Swale | SE | £96,492,000 | £5,175,000 | 5.7%

Tunbridge Wells | SE | £96,046,000 | £4,612,000 | 5.0%

Thanet | SE | £92,966,000 | £4,857,000 | 5.5%

Woking | SE | £91,418,000 | £5,005,000 | 5.8%

Mole Valley | SE | £88,615,000 | £4,889,000 | 5.8%

Bracknell Forest | SE | £88,369,000 | £5,761,000 | 7.0%

Spelthorne | SE | £87,143,000 | £5,529,000 | 6.8%

Lewes | SE | £86,287,000 | £3,493,000 | 4.2%

Surrey Heath | SE | £85,950,000 | £4,736,000 | 5.8%

Rother | SE | £85,682,000 | £3,576,000 | 4.4%

Hart | SE | £84,585,000 | £3,910,000 | 4.8%

Folkestone & Hythe | SE | £84,221,000 | £4,130,000 | 5.2%

Tandridge | SE | £84,190,000 | £8,289,000 | 10.9%

Fareham | SE | £82,141,000 | £7,644,000 | 10.3%

Dover | SE | £81,849,000 | £4,231,000 | 5.5%

Slough | SE | £80,975,000 | £5,156,000 | 6.8%

Havant | SE | £80,730,000 | £4,034,000 | 5.3%

Dartford | SE | £80,468,000 | £4,074,000 | 5.3%

Worthing | SE | £79,648,000 | £3,104,000 | 4.1%

Eastbourne | SE | £76,494,000 | £3,931,000 | 5.4%

Runnymede | SE | £73,259,000 | £3,897,000 | 5.6%

Epsom and Ewell | SE | £71,865,000 | £3,462,000 | 5.1%

Crawley | SE | £71,474,000 | £3,364,000 | 4.9%

Gravesham | SE | £69,594,000 | £3,840,000 | 5.8%

Rushmoor | SE | £62,308,000 | £2,530,000 | 4.2%

Hastings | SE | £58,962,000 | £3,563,000 | 6.4%

Gosport | SE | £51,160,000 | £187,000 | 0.4%

Adur | SE | £45,698,000 | £1,784,000 | 4.1%

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

East of England | E | £4,406,439,000 | £221,953,000 | 5.3%

Central Bedfordshire | E | £235,282,000 | £10,088,000 | 4.5%

East Suffolk | E | £174,713,000 | £7,162,000 | 4.3%

South Cambridgeshire | E | £136,111,000 | £8,203,000 | 6.4%

Chelmsford | E | £133,395,000 | £6,401,000 | 5.0%

Huntingdonshire | E | £132,334,000 | £7,376,000 | 5.9%

St Albans | E | £127,897,000 | £5,667,000 | 4.6%

Colchester | E | £126,569,000 | £6,921,000 | 5.8%

East Hertfordshire | E | £126,568,000 | £5,496,000 | 4.5%

Bedford | E | £126,351,000 | £5,638,000 | 4.7%

Basildon | E | £121,713,000 | £5,918,000 | 5.1%

Dacorum | E | £117,558,000 | £6,124,000 | 5.5%

Luton | E | £116,099,000 | £7,903,000 | 7.3%

West Suffolk | E | £113,610,000 | £5,000,000 | 4.6%

Southend-on-Sea | E | £112,359,000 | £5,819,000 | 5.5%

Peterborough | E | £112,107,000 | £5,744,000 | 5.4%

Braintree | E | £109,799,000 | £7,597,000 | 7.4%

South Norfolk | E | £106,868,000 | £5,396,000 | 5.3%

Kings Lynn & West Norfolk | E | £105,794,000 | £4,057,000 | 4.0%

Epping Forest | E | £105,619,000 | £4,105,000 | 4.0%

Tendring | E | £99,943,000 | £9,861,000 | 10.9%

North Hertfordshire | E | £99,724,000 | £3,047,000 | 3.2%

Broadland | E | £96,156,000 | £4,163,000 | 4.5%

Breckland | E | £91,393,000 | £4,250,000 | 4.9%

Cambridge | E | £91,271,000 | £6,671,000 | 7.9%

Thurrock | E | £90,862,000 | £3,494,000 | 4.0%

Welwyn Hatfield | E | £87,182,000 | £5,165,000 | 6.3%

Hertsmere | E | £84,534,000 | £4,584,000 | 5.7%

North Norfolk | E | £83,959,000 | £3,187,000 | 3.9%

Norwich | E | £79,540,000 | £4,318,000 | 5.7%

Ipswich | E | £79,530,000 | £2,680,000 | 3.5%

Three Rivers | E | £78,493,000 | £3,851,000 | 5.2%

Mid Suffolk | E | £76,287,000 | £4,181,000 | 5.8%

Uttlesford | E | £76,098,000 | £3,416,000 | 4.7%

Watford | E | £69,692,000 | £4,441,000 | 6.8%

Broxbourne | E | £69,326,000 | £4,557,000 | 7.0%

Babergh | E | £67,865,000 | £3,164,000 | 4.9%

Rochford | E | £65,451,000 | £3,462,000 | 5.6%

Fenland | E | £65,262,000 | £3,570,000 | 5.8%

Brentwood | E | £65,168,000 |

Local authority | Region - Total receipts of council taxes collected during the financial year - 2022 to 2023 (Q1 to Q4) - (£ full number) | Annual Change (n) | Annual Change (%)

London, L, £5,228,073,000, £331,831,000, 6.8%

Croydon, L, £261,802,000, £18,275,000, 7.5%

Barnet, L, £258,729,000, £11,949,000, 4.8%

Bromley, L, £239,776,000, £9,198,000, 4.0%

Ealing, L, £212,901,000, £15,261,000, 7.7%

Lambeth, L, £183,587,000, £8,133,000, 4.6%

Harrow, L, £182,374,000, £8,764,000, 5.0%

Richmond upon Thames, L, £181,760,000, £7,522,000, 4.3%

Brent, L, £179,325,000, £14,290,000, 8.7%

Enfield, L, £178,712,000, £6,947,000, 4.0%

Havering, L, £176,401,000, £7,883,000, 4.7%

Hillingdon, L, £168,494,000, £9,966,000, 6.3%

Southwark, L, £167,884,000, £12,737,000, 8.2%

Redbridge, L, £167,539,000, £7,448,000, 4.7%

Lewisham, L, £165,099,000, £11,266,000, 7.3%

Tower Hamlets, L, £164,392,000, £13,224,000, 8.7%

Camden, L, £163,071,000, £5,575,000, 3.5%

Hounslow, L, £159,611,000, £11,366,000, 7.7%

Bexley, L, £158,110,000, £8,388,000, 5.6%

Waltham Forest, L, £153,787,000, £7,848,000, 5.4%

Haringey, L, £152,351,000, £9,789,000, 6.9%

Greenwich, L, £148,957,000, £9,512,000, 6.8%

Sutton, L, £143,943,000, £6,126,000, 4.4%

Islington, L, £139,115,000, £8,126,000, 6.2%

Merton, L, £137,978,000, £7,183,000, 5.5%

Kensington & Chelsea, L, £137,047,000, £5,451,000, 4.1%

Kingston upon Thames, L, £136,872,000, £6,369,000, 4.9%

Hackney, L, £131,532,000, £45,146,000, 52.3%

Newham, L, £126,949,000, £10,589,000, 9.1%

Wandsworth, L, £125,377,000, £8,629,000, 7.4%

Westminster, L, £121,347,000, £10,050,000, 9.0%

Hammersmith & Fulham, L, £100,548,000, £2,810,000, 2.9%

Barking & Dagenham, L, £93,065,000, £5,608,000, 6.4%

City of London, L, £9,638,000, £403,000, 4.4%

Okay, let’s say you’ve missed a few Council Tax payments and can’t see an easy way to pay up. Don’t fool yourself into thinking that the authorities won’t notice, and don’t wait for them to get in touch with you before you decide to do something about it. Hop on the phone to the council office and talk them through the difficulties you’re having. You’ll almost certainly still end up having to pay what you owe in full, but there’s a good chance they’ll be able to offer you easier ways to do it. If you ignore the problem, you’re probably going to find yourself facing court costs, bailiff bills and potentially lots more trouble on top.

Read more about council tax rebates

Of course, all these different kinds of loan aren’t much use if you don’t have a strong credit history to fall back on. That’s where credit builder loans come in. These agreements are built to put much-needed financing within the reach of people who couldn’t otherwise access them. The system works by the lender paying the amount to be borrowed into a savings account. The borrower then makes monthly repayments at a fixed rate for anything between 6 months and 2 years. Once the loan’s repaid, the borrower gets the cash back, possibly with some interest on top.

Why is this useful? Well, a credit builder loan is less about getting some up-front cash than it is about building up your overall credit rating. If you’ve only got a limited credit history, signing up to this kind of deal is a decent way to boost your score and make other lenders take you seriously, by establishing a track record of sticking to a repayment schedule. Of course, to make this work you need to be sure your lender’s reporting the deal to the organisations that track your credit score.

This can get pretty complicated, very quickly, so we’ll keep it simple: The exchange rate is how much it costs to buy another currency.

For example, at the time of writing (Aug ‘22), you can buy one Euro for 84p - so 100 Euro will cost you £84. Give or take a few pennies!

If you’re buying pounds with Euros, £1 will cost you 1.19 Euro.

And a US Dollar will cost you 83p.

When they say the pound ‘is strong’, that means it costs more. Exchange rates go up or down depending on market conditions. If you’re taking cash on holiday, it’s advised to monitor the exchange rate and shop around. You’ll find a few comparison tools online like Compare Holiday Money.

Read our guide: Understanding comparison sites

Hotels and airports tend to be the most expensive places to exchange currency. And if you’re waiting until you get there to withdraw cash from the cashpoint, always do it in the local currency. Just don't forget to check if your bank charges ATM or foreign transaction fees.

Back in 2017, mobile networks were stopped from charging customers extra to use their phones in other EU countries. Since Brexit, we here in the UK have lost this protection against roaming charges.

You can read all about it here, but the most important takeaway before you go-away is to check your mobile phone provider’s charges.

Almost all the big companies have reintroduced EU roaming charges and many are introducing fair usage policies. For example, Giffgaff will allow members to use up to 5GB when roaming in the EU at no extra cost. They say that’s fair and reasonable as more than 90% of members use less than that when roaming abroad.

There are a couple of practical things you can do to avoid excess charges or a shocking bill when you get back from holiday:

Think about it this way: you’re getting away from it ALL! A holiday is a great opportunity to have a break from your socials.

If you’ve got travel money left over, converting this to pounds sterling is called ‘buying back’.

Currency buy-back services will buy your Euros, dollars or other cash at the current buy-back rate – that is how many pounds you can get for it.

If you’re offered a Euro buy-back rate of 0.8, for example, you’ll get 80p for every Euro you sell.

You can choose which service to use – look for one that is offering you the best exchange rate and watch out for any additional fees.

It’s good to know that if you bought your travel money at the Post Office and still have your receipt, they will buy back leftover notes without charging you commission.

Tax debts have a nasty habit of creeping up on you, mainly because people don’t understand the rules. The first many people even hear about a tax debt is when HMRC gets in touch about it. Pretty soon they find themselves fines and stacking penalties. Not long after that comes the phone call from HMRC Debt Management and Banking (DM).

You can’t afford to ignore a warning from HMRC that you owe a tax debt, even if you’re sure it’s a mistake. HMRC has a whole range of options it can pursue to reclaim the money they’re owed, including:

Here are some common penalties HMRC can apply:

Keep in mind that HMRC automatically charges interest on late tax payments as well. If you’ve got a really good reason for missing the deadlines, you might be able to argue your penalties down or appeal against them. Don’t count on that, though. The list of valid excuses is pretty short.

Remember we mentioned that the important thing is to understand you’re not alone? It’s so easy to get caught up in your own head when you’ve got debts that feel out of control. This goes for all kinds of debt, not just taxes. When there’s interest stacking up and legal threats looming, it can feel like a lonely and dangerous world. However, there’s a whole range of support for people with debt problems. The right help for you is going to depend on your circumstances – but in a lot of cases it might be as simple as claiming a tax rebate.

Every year, HMRC ends up sitting on many millions in unclaimed tax refunds – simply because people don’t realise what they’re owed. When you’re paid via PAYE, many of the essential expenses of doing your job can earn you tax back from HMRC each year. For most refund claims, this means getting tax relief for travel to temporary workplaces, but there are lots of other expenses you can claim for.

For the self-employed, the system’s a little different, since you’re actually being taxed on your profits. When you file your Self Assessment return, all the necessary costs of doing business count against the income you’re paying tax on.

In either case, the rules on expenses can be tricky to get your head around, so lot of people choose to get professional help. Getting your taxes sorted properly, whether on your own or with expert help, can be a big step toward ending debt problems before they start.

When it comes to mental health problems, the first and most important step is recognising the signs. Crucially, it’s just as essential to learn to spot them in your colleagues, friends and family as in yourself. Here are a few early warning signs that you or someone else may be struggling with mental health.

That's a long list - and almost everyone can check off a few of those symptoms from time to time. The trick is recognising when you're getting swamped by things, and reaching out before it goes too far.

With debt problems, it’s tempting to look for “quick fix” solutions – but that’s usually a mistake. A lot of people simply end up swapping one set of debts for another, potentially much larger, one. The same goes for looking after your mental health. Any looming problem become a lot more manageable when you break it down into smaller steps. With debt, that can mean spotting the signs of trouble early, understanding the causes and making a plan to tackle them.

The exact same process applies to mental health. It can be tough to break the cycle of mounting money problems causing stress or anxiety – which then only worsen the money trouble. The best place to start is often with the practical side – cutting out problem spending and bringing down the cost of your debts. However, that won’t always be possible when your mental health is tripping up your efforts. Again, though, taking small positive steps is the surest way to get things moving in the right direction. That can mean coming to terms with the relationship between your mood and your spending habits, for example. Once you start spotting the patterns, it can get a lot easier to attack the problem at its roots.

If you’re worried about getting professional mental health help, don’t be. There’s a lot more to it than the old stereotypes of medication and side-effects suggest. In fact, a lot of mental health issues can be handled without ever getting a prescription, through things like Cognitive Behavioural Therapy. For many people, improving mental health is all about changing the way they think. It takes a little practice, but can be very effective if you stick with it.

The main point is to give yourself permission to take back control. Once you’ve seized the reins of your own mental health, you’ll be in a much better position to be proactive about your debts. While you’re at it, give yourself permission to get qualified help as well. There’s no shame in suffering from poor mental health, just as there’s no shame in struggling with debt. Don’t be fooled into thinking you have to tough out either alone. No debt crisis is impossible to fix, and there’s a whole range of organisations out there offering real, practical and judgement-free solutions. You can get free of your debts with the right guidance, and no one needs to suffer alone through a mental health crisis.

This is the big one, the older brother of the Debt Relief Order. Like a DRO, you get some protection from your creditors in exchange for accepting some restrictions on your finances and behaviour. Your situation will be checked out by the Insolvency Service and your rights and responsibilities will be explained. You might, for instance, have to hand over bank cards or sell off some of your possessions to help pay what you owe. Despite this, bankruptcy is as much about protecting you as repaying your creditors. Stick to the rules and, after 12 months, you'll automatically be 'discharged' from bankruptcy and your remaining debts will be written off. See here for more.

A P45 is form showing how much PAYE tax you’ve paid in the current tax year. You’ll get one of these from your employer when you stop working for them, which may be part-way through a tax year.

A P60 is an end-of-year certificate showing all the taxable income you’ve made and the PAYE tax and National Insurance you’ve paid on it for the whole tax year. It also includes details of your Student Loan repayments. Click the button below to read more.

Sadly, the answer is a resounding yes! Depending on your situation, you could find yourself paying a few different kinds of tax as a student. Here are a few examples:

We’ve already talked a bit about this above but, even when you’re a student, when there’s money coming in the taxman wants his share. What you pay depends on what you earn in a year:

If you’re sharp-eyed, you’ll spot that you can actually earn a fair bit of cash before you start paying any tax on it. The Personal Allowance is the tax-free chunk of your earnings, and at £12,570 it means that a lot of students won’t have to pay Income Tax at all! Again, though, that doesn’t mean that HMRC won’t dip its fingers into your pocket. Remember we talked about National Insurance? Well, here’s what that looks like:

This is still broadly lumped under Income Tax, but it’s worth mentioning separately. Students are usually in the Basic Rate tax bracket, and the rules say that means they can earn up to £1,000 of savings interest tax-free a year. When people earn enough to pay Higher Rate tax, that allowance drops to £500 a year.

Not everything you buy is eligible for VAT. When it is, the tax is simply lumped into the price tag so you don’t have to do anything (other than decide if you can still afford it). If you’re running your own business, you sometimes have to register for VAT and start charging it to your customers. You can then claim back the VAT you’re paying on some of your business costs. You won’t need to bother about this until you’re earning over £85,000 (as of 2019/20), so for most students it won’t be an issue.

Council Tax is charged on pretty much all UK properties, from mansions to caravans. It’s based on the value of the property, but there are some important rules for students to understand:

Read our guide: Council Tax Debt

Okay, so you won’t actually pay tax on your loan as if it were income, but the chances are you’ll be paying it off through the tax system. Again, there’s a threshold involved – meaning you won’t have to pay any of your loan back if you don’t earn enough to qualify. The threshold depends on the kind of loan you’ve got.

For 2019/20:

As for how you’ll be making those repayments, it all depends on the way you pay your normal tax. If you work for an employer, you use PAYE. If you’re self-employed, it’ll be in your Self Assessment tax returns. Some people might actually be both, meaning they’ll have to use both systems. They won’t end up paying double, though. The payments made through PAYE count against your Self Assessment tax.

Postgraduate loans are slightly different. For these, you start paying once your earnings hit £21,000, and on other income over £2,000 a year that you’re declaring via Self Assessment.

The Universal Credit (UC) system doesn’t really care if you’re a student or not. You’ll still have to meet the normal criteria to qualify for it. If you’re studying full-time, you’ll need to fit one of the following descriptions to claim: